A responsibility that all people share is to pay their federal taxes. While you may have taxes withdrawn from each paycheck throughout the year, your taxes are due on the filing date, which is typically around April 15. While most people will be able to stay current with their tax bills, there are situations in which someone could fall behind. In these situations, if you have past due taxes, there are various serious penalties that could occur. One penalty to be aware of is a potential IRS tax lien.

What is a Tax Lien?

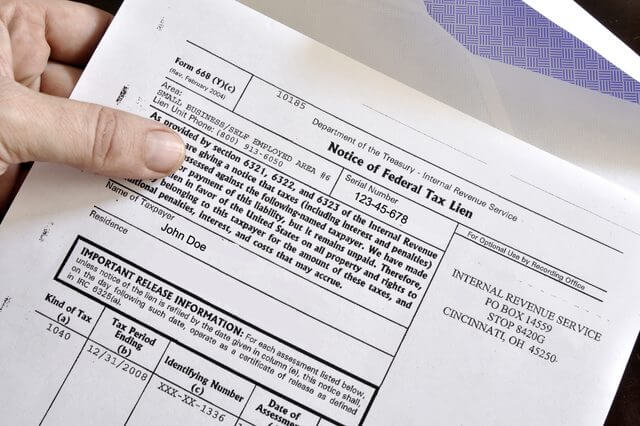

One of the ways that the IRS can force individuals to pay their back taxes is by placing a tax lien on their assets. A tax lien is ultimately a legal claim by the IRS to the underlying asset. The IRS is able to place liens on your home, car, bank accounts, and other assets that have a monetary value. When a lien exists, it could make it difficult for you to sell or refinance an asset until the lien clears. In some cases, the lien could allow the IRS to withdraw funds from your bank account.

In other situations, if someone continues to stay behind on their taxes, they could be assessed with a tax levy. In these situations, the government can actually take possession of your assets and force a sale or liquidation to cover the past due balance. Due to this, avoiding tax liens and levies is very beneficial.

How to Avoid and Manage a Tax Lien

Due to the serious consequences that can come with a tax lien, it is important to avoid them altogether. The most common way to avoid a tax lien is by paying your taxes on time. However, financial situations could preclude someone from being able to do this. There are other tips that you can follow that could help you avoid one of these liens.

Personal Bankruptcy

One way that you can avoid a tax lien is by filing for personal bankruptcy. Under bankruptcy law protection, a lien will not be able to be filed against your assets. Generally, you will need to have filed for bankruptcy prior to the lien being filed.

Spousal Protection

For many married couples, taxes will be filed jointly. However, there is often one individual that handles the tax preparation and responsibility to pay the bill on time. If there are past due taxes due to the errors or lack of payment of one spouse, it could lead to a lien on assets owned by either individual. However, the spouse that is not at fault could appeal liens placed on assets in their own name. Any jointly-owned assets will likely continue to have the tax lien in place.

Fresh Start Program

One of the best solutions to help someone stay in good standing with the IRS is to take advantage of the IRS Fresh Start program. With this program, any tax debt that you owe can be paid back to the IRS over a six-year period through a loan program. One of the advantages of this program is that any tax liens will be released as long as you continue to stay current with payments.

It is very important that all people make their federal tax payments on time to avoid federal tax liens and levies. One of the best ways that you can ensure this happens is by making all of your payments on time. However, there are other ways that you can avoid an IRS tax lien and have it cleared if one is filed.

Hey, this is Johny Sehgal. I am the owner and caretaker at Finance Jungle. I completed my education in BSC and now heading towards the digital marketing industry. I usually have interests in reading, playing games and watching movies. I also love to write content based on quality information. The main motive of mine is to provide the top and best quality information to my readers. Finance Jungle is the blog for the same.