You may have noticed the State Bank of India stock price has been on the rise lately.

Investors are taking notice of the SBI’s potential for growth, and the stock price is expected to continue to rise in the coming months. If you’re thinking about investing in SBI, whether or not, now is the time to do it, we will study it in this article!

In this article, we’ll take a closer look at the SBI stock price and what’s driving it up.

We’ll also discuss some of the risks and rewards associated with investing in this stock. By the end, you’ll be able to make an informed decision about whether or not to invest in SBI.

What Is the State Bank of India?

The State Bank of India is a govt. owned public-sector banking and financial services company. It’s the largest bank in India by market capitalization and assets.

The State Bank of India was founded in 1955, and it currently has over 18,000 branches and 58,000 ATMs across the country. The company offers a wide range of products and services, including personal banking, corporate banking, investment banking, and more.

The State Bank of India stock is publicly traded on the Bombay Stock Exchange and the National Stock Exchange of India.

What Is the Stock Price of the State Bank of India?

So what is the stock price of the State Bank of India? As of right now, it’s 607.20INR. But that number can change at any time, so it’s important to keep an eye on it.

The stock price is important because it tells you how much people are willing to pay for a share of the company. And the higher the stock price, the more confident people are in the company’s future.

If you’re thinking about investing in SBI, then it’s important to keep track of the stock price and make sure that it’s going in the right direction.

History of the State Bank of India

The State Bank of India is one of the largest and most respected banks in India. It was originally founded in 1806 by the British East India Company and has been providing banking and financial services to the people of India ever since.

The bank has a long and illustrious history and has been involved in some of the most important moments in Indian history. For example, it was instrumental in the country’s independence movement and played a key role in the establishment of the Indian Republic.

The State Bank of India is also one of the largest and most profitable banks in the world, with total assets of over 2 trillion dollars. And its stock price is among the most sought-after on the Indian stock market.

How to Buy Shares of the State Bank of India?

The State Bank of India is India’s largest commercial bank, and its stock is a popular investment choice. Here’s how to buy shares in the State Bank of India:

- You need a demat account, which you can create with Groww or SBI securities.

- Complete your KYC.

- Connect your bank account

- Transfer money to your the demat account from your bank account.

- Search for “SBI” and click on the link for the State Bank of India stock.

- Click on the “buy” button and enter the number of shares you want to purchase.

- Confirm your order and wait for the shares to be transferred to your account.

Why Has the SBI Stock Price Changed?

So what’s causing the stock price to rise? There are a few different factors at play with SBI.

The first is the interest rates.

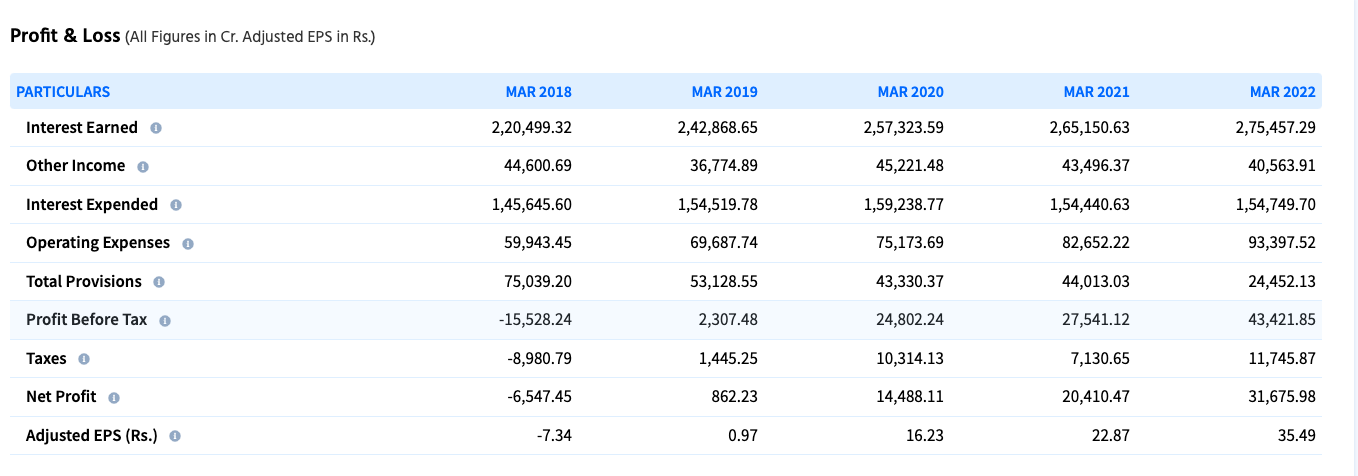

State Bank of India has turned profitable, posted great results, lately. From running into losses, to taking the yearly profit to more than 31675Crore INR

Another issue is the bad loans that the bank has been dealing with. In recent years, SBI has been increasing its provisioning for bad loans, which has resulted in lower profits and a lower stock price.

Finally, there’s the issue of competition from new private banks in India. These banks are offering better interest rates and more services, which is taking away market share from SBI.

Things to know before buying SBI Stock Today

SBI share price is trading near its ATH. After playing in the range for multiple years, it broke out of the resistance and started moving up.

This means, taking an entry now at SBI could be a good short term play, but for long term, if you wish to buy SBI shares in bulk, the entry may not be a suitable one.

Conclusion

State Bank of India (SBI) offers a range of products and services, including savings and current accounts, loans, and investment options.

The SBI stock price can be affected by a variety of factors, including the bank’s performance, interest rates, and political or economic conditions in India. If you’re thinking of investing in SBI stock, it’s important to stay up-to-date on the latest news and developments that could impact its price.

Hey, this is Johny Sehgal. I am the owner and caretaker at Finance Jungle. I completed my education in BSC and now heading towards the digital marketing industry. I usually have interests in reading, playing games and watching movies. I also love to write content based on quality information. The main motive of mine is to provide the top and best quality information to my readers. Finance Jungle is the blog for the same.