Mobile payments and digital wallets is experiencing a dynamic evolution, shaping the future of financial transactions globally. With the proliferation of smartphones and the increasing digitization of financial services, mobile payments and digital wallets have become integral components of everyday life. From contactless payments and peer-to-peer transfers to loyalty programs and in-app purchases, the landscape is characterized by convenience, security, and innovation. As consumers seek seamless and efficient payment solutions, the trends in mobile payments and digital wallets continue to redefine the way individuals manage their finances, interact with businesses, and navigate the digital economy.

Top 7 Trends in Mobile Payments and Digital Wallets are:

1. Contactless Payments

Contactless payments have revolutionized the way transactions are conducted, offering a swift, convenient, and hygienic alternative to traditional payment methods. Utilizing near-field communication (NFC) technology, contactless payments allow users to simply tap their mobile device or contactless-enabled card on a compatible terminal to complete a transaction, without the need to swipe or insert a card or enter a PIN. The widespread adoption of contactless payments has been accelerated by factors such as increased smartphone usage, the proliferation of contactless-enabled cards, and the emphasis on hygiene amidst the COVID-19 pandemic.

Businesses across various industries, including retail, hospitality, and transportation, have embraced contactless payment technology to enhance the customer experience, improve transaction efficiency, and minimize physical contact. Contactless payments offer enhanced security features, such as tokenization and biometric authentication, reducing the risk of fraud and unauthorized transactions. As consumers continue to prioritize convenience and safety in their payment preferences, contactless payments are poised to remain a dominant force in the financial landscape, driving further innovation and expansion in the realm of digital transactions.

2. Biometric Authentication

Biometric authentication, a cutting-edge security measure, verifies individuals’ identities through unique physical or behavioral characteristics. Utilizing biometric data such as fingerprints, facial features, iris patterns, voiceprints, or even behavioral traits like typing patterns or gait, this technology offers a highly secure and convenient means of authentication. Unlike traditional passwords or PINs, which can be forgotten, stolen, or shared, biometric authentication provides a virtually foolproof method of identity verification.

The adoption of biometric authentication has surged across various sectors, including finance, healthcare, government, and technology, driven by the need for robust security measures in an increasingly digital world. Moreover, biometric authentication enhances user experience by streamlining access to devices, applications, and services, eliminating the need for cumbersome passwords or PINs. However, concerns regarding privacy, data security, and potential biometric spoofing remain significant considerations in the widespread implementation of this technology. Biometric authentication is poised to become an indispensable tool for safeguarding digital identities and securing sensitive information in the years to come.

3. Tokenization Technology

Tokenization technology is a powerful security measure that replaces sensitive data, such as credit card numbers or personal identification details, with unique tokens. These tokens are randomly generated and serve as placeholders for the original data, rendering it useless to unauthorized parties. Tokenization enhances data security by reducing the risk of data breaches and fraud. The original data is never stored or transmitted in its vulnerable form. Instead, tokens are used for transactions, ensuring that sensitive information remains protected at all times.

This technology is widely employed in various sectors, including payment processing, e-commerce, and digital banking. To safeguard customer data and comply with stringent security regulations. Additionally, tokenization technology facilitates seamless and secure transactions across multiple platforms and devices, without compromising user privacy or security. Tokenization technology plays a crucial role in bolstering cybersecurity measures and instilling confidence among consumers and businesses alike. With its proven effectiveness in mitigating security risks and protecting sensitive information, tokenization is poised to remain a cornerstone of modern data protection strategies in an increasingly digitized world.

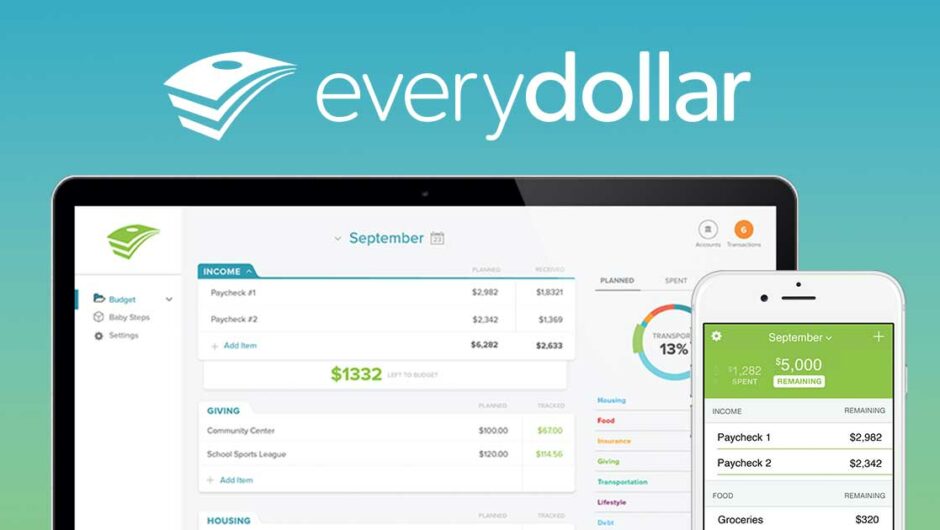

4. Integration of Digital Wallets with Lifestyle Services

The integration of digital wallets with lifestyle services marks a significant shift in the capabilities and functionalities of these payment solutions, extending beyond traditional transaction processing to offer a comprehensive suite of features tailored to users’ daily lives. By integrating with various lifestyle services, digital wallets transform into multifunctional platforms that cater to diverse consumer needs and preferences. For instance, users can seamlessly access loyalty programs, ticketing services, transportation options, and digital ID verification directly from their digital wallet apps.

This integration streamlines the user experience, eliminating the need to switch between multiple apps or platforms for different tasks. Furthermore, digital wallets enhance convenience and efficiency by consolidating various lifestyle services into a single, user-friendly interface, allowing users to manage their daily activities and transactions seamlessly. The integration of digital wallets with lifestyle services opens up new opportunities for businesses to engage with customers. Offer personalized experiences, and drive customer loyalty. The integration of lifestyle services is poised to become a standard feature. Enriching the functionality and utility of digital wallet solutions in the modern digital ecosystem.

5. Increased Adoption of QR Code Payments

The increased adoption of QR code payments represents a significant shift in the way transactions are conducted. Particularly in emerging markets where mobile technology penetration is high. QR code payments allow users to initiate transactions by scanning a QR code displayed by the merchant using their smartphone camera or a dedicated app. This method offers several advantages, including simplicity, speed, and low transaction costs, making it particularly appealing for small businesses and individuals.

QR code payments require minimal infrastructure investment, as merchants only need a QR code generator and a smartphone or tablet to accept payments, democratizing access to digital payment solutions. Furthermore, QR code payments are inherently secure. They rely on tokenization and encryption to protect sensitive transaction data. QR code payments have gained traction in various sectors, including retail, hospitality, transportation, and peer-to-peer transactions.

6. Rise of Peer-to-Peer (P2P) Payments

The rise of peer-to-peer (P2P) payments signifies a transformative shift in the way individuals transfer funds. Enabling seamless and instant transactions between friends, family, and businesses. P2P payment platforms facilitate the transfer of funds directly from one user’s bank account or digital wallet to another. Typically, through a mobile app or online platform. This method offers unparalleled convenience, allowing users to split bills, repay debts, or send money to loved ones with just a few taps on their smartphone.

P2P payments eliminate the need for cash or checks, streamlining the payment process and reducing reliance on traditional banking methods. As a result, P2P payments have become increasingly popular among millennials and digitally savvy consumers who prioritize speed, convenience, and cost-effectiveness in their financial transactions. P2P payment platforms often offer social features, such as messaging and group payments. Further enhancing the user experience and fostering greater engagement. With the growing acceptance of digital payments and the proliferation of mobile devices.

7. Expansion of Cryptocurrency Payments

The expansion of cryptocurrency payments marks a significant evolution in the way transactions are conducted. Offering an alternative to traditional fiat currencies and revolutionizing the global financial landscape. Cryptocurrency payments enable individuals and businesses to transact directly with each other. Bypassing intermediaries such as banks or payment processors. This method offers several advantages, including lower transaction fees, faster settlement times, and increased privacy and security through blockchain technology.

Cryptocurrency payments facilitate cross-border transactions without the need for currency conversion. This is making them particularly appealing for international commerce. As a result, an increasing number of merchants and service providers are embracing cryptocurrency payments. With the rise of digital wallets and payment platforms that support cryptocurrency transactions. Such as Bitcoin, Ethereum, and Litecoin, the expansion of cryptocurrency payments is expected to continue. Consumers and businesses greater flexibility and freedom in their financial transactions while driving innovation in the fintech industry.

Conclusion

The evolving landscape of mobile payments and digital wallets reflects a dynamic shift towards convenience, security, and innovation in financial transactions. With the increasing adoption of mobile devices and the proliferation of digital payment solutions. Consumers are embracing the versatility and accessibility of mobile payments and digital wallets. From contactless payments to peer-to-peer transfers and cryptocurrency transactions. These trends underscore a growing preference for seamless, efficient, and secure payment methods. The future of mobile payments and digital wallets promises continued growth. Offering unparalleled convenience and transforming the way individuals and businesses manage their finances in the digital age.

Also Read:

- What is Dividend Investing and How to find Dividend Stocks?

- How do new mobile banking apps help access savings account better?

- Financial Advisor in India – The Best for your Financial Planning?

- What is inflation and how it impacts your financial plan?

Hello, I am Tanisha Kriplani, graduated in computer science from Delhi University. I am passionate about web content writing and have a strong interest in Data Analytics and Data Engineering.