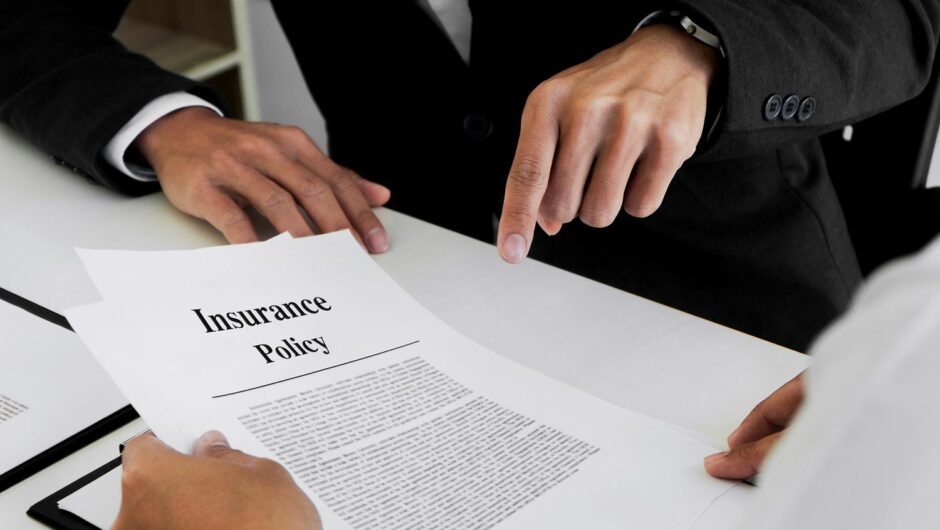

A term insurance plan is a basic policy designed exclusively to protect your family’s financial needs when they are left financially stranded in your absence. A term life insurance plan will ensure that your family is financially provided for in your absence. But all the term plan benefits are applicable within the policy tenure you opted for.

So, what happens if the term insurance policy expires? Are the benefits provided after the policy term? What are the actions required from your end? Can the benefits continue and if yes, how? Let us find out more to answer these questions.

What is a term insurance plan?

Term insurance is a pure life insurance plan that provides a sum assured to the nominee if you meet with sudden death during the policy term. It is provided against the regular premium amount paid towards the plan. If you start a term insurance plan early, you can reap substantial benefits, such as low premiums, high sum assured, longer coverage, riders at low additional costs, and flexible payout options.

As term insurance is meant to support your family in case of any unfortunate event, you must be careful in paying the premiums regularly and updating the details on the policy. If you are nearing the expiry of the term of the policy, there are several options available that you can choose according to your needs at that point in time.

What happens to the benefits when your term insurance expires?

When a term plan expires, the benefits also generally cease to accrue. It means your family will no longer get financial protection in the event of your death. However, you can avoid this situation by taking the following steps:

- Term plan extension: Around the expiry date of your term plan, you can always contact your insurer and get the policy extended as per your needs. You will be entitled to receive the same benefits in the new policy term as well. The TATA AIA term plan by default provides different options to ensure life coverage till 100 years of age and offers provisions to include your life partner for joint protection.

- Term insurance renewal: You can opt to renew the policy for its benefits relatively faster. With the online term plan, it becomes easier and cost-efficient as well. Further, it is faster and with less chances of fraud. There are varying online payment modes to facilitate easy money transfer.

For extending or renewing your term insurance, you should consider the coverage required and adjust it based on any health conditions or other factors. Increasing or decreasing the coverage could accordingly lead to a change in the premium to be paid.

However, if you feel that you may not require life insurance after a certain age but not sure about it due to family commitments, you can consider the following types of term insurance options as well.

Types of Term Insurance Plans

- Term insurance with return of premium rider: You can purchase a term plan with the return of premium add-on rider. It will provide a complete refund of the premium amount paid on maturity if you outlive the policy term.

- Decreasing term plan: In a decreasing term plan, the sum assured keeps decreasing while the premium amount remains constant. It is an ideal option if your liabilities keep decreasing due to repayment of loans or if your children will start earning to manage your family life after a certain time.

- Increasing term plan: You can also consider purchasing an increasing term plan, wherein the sum assured will keep increasing. It is the best term plan if you are in the process of increasing the standard of your life and would like to ensure the same for your family members later, even in your absence.

If you choose a new term life insurance policy, the premiums you would pay can be high. You can check the premium calculator to determine the amount of premium and pay the premium according to your convenience on a monthly, quarterly, half-yearly or annual basis.

Conclusion

Term insurance is the best way to secure your family’s financial requirements at different stages in life. However, if it is bound to expire, you have to either extend or renew it based on your convenience to ensure continued protection. Take timely actions and smart decisions based on your requirements for your term insurance plan!

Hey, this is Johny Sehgal. I am the owner and caretaker at Finance Jungle. I completed my education in BSC and now heading towards the digital marketing industry. I usually have interests in reading, playing games and watching movies. I also love to write content based on quality information. The main motive of mine is to provide the top and best quality information to my readers. Finance Jungle is the blog for the same.