Financial counseling offers invaluable guidance and support for individuals seeking to improve their financial well-being. Understanding how financial counseling works is essential for those navigating financial challenges or seeking to achieve specific financial goals. In this guide, we’ll explore the key aspects of financial counseling, including its benefits, the process involved, and what to expect from counseling sessions. From budgeting and debt management to retirement planning and investment strategies, financial counseling provides personalized advice and tools to help individuals make informed decisions and achieve financial success.

Understanding Financial Counseling: An Overview

Understanding financial counseling involves grasping its role in guiding individuals towards improved financial well-being. Financial counseling provides personalized guidance and support to help individuals navigate various financial challenges and achieve their financial goals. It typically involves a collaborative process between a certified financial counselor and the client, focusing on areas such as budgeting, debt management, savings, investments, and retirement planning.

Through financial counseling, individuals can gain valuable insights into their financial situation, develop effective strategies to manage their finances, and make informed decisions about their money. Counselors assess the client’s financial status, goals, and concerns to tailor advice and recommendations to their specific needs. By empowering individuals with financial knowledge and skills, financial counseling aims to enhance financial literacy, reduce financial stress, and promote financial stability and success.

Benefits of Financial Counseling: Improving Financial Well-Being

Benefits of financial counseling are numerous, offering individuals valuable tools and support to enhance their financial well-being. Through financial counseling, individuals can gain clarity and confidence in managing their finances, leading to reduced stress and anxiety. Counselors provide personalized guidance tailored to the client’s specific financial situation, helping them set realistic goals and develop actionable plans to achieve them.

Financial counseling fosters financial literacy, empowering individuals to make informed decisions about budgeting, debt management, savings, and investments. By addressing financial challenges and developing effective strategies, individuals can improve their financial habits, build savings, and work towards financial stability. Moreover, financial counseling can help individuals navigate life transitions, such as buying a home, starting a family, or planning for retirement, ensuring they are well-prepared for future financial milestones. Overall, the benefits of financial counseling extend beyond monetary gains, contributing to overall well-being and peace of mind.

The Process of Financial Counseling: From Assessment to Action

The process of financial counseling involves several key steps designed to help individuals address their financial challenges and achieve their goals. It begins with an initial assessment, where the counselor evaluates the client’s financial situation, goals, and concerns. Based on this assessment, personalized recommendations and strategies are developed to address specific needs and objectives.

Next, the counselor and client work collaboratively to create an action plan, outlining the steps needed to achieve financial success. This may include budgeting, debt management, savings strategies, or investment planning, tailored to the client’s circumstances.

Throughout the counseling process, the counselor provides ongoing support, guidance, and accountability, helping the client stay on track towards their goals. Regular check-ins and reviews allow for adjustments to the action plan as needed.

Setting Financial Goals: Defining Objectives and Priorities

Setting financial goals is a crucial step in the financial counseling process, helping individuals clarify their objectives and prioritize their efforts. It involves defining specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with the client’s aspirations and values. Financial goals may include paying off debt, saving for emergencies, retirement planning, purchasing a home, or funding education.

During financial counseling sessions, clients work with counselors to identify their short-term, medium-term, and long-term financial goals. Counselors assist clients in evaluating their current financial situation, assessing their resources and constraints, and developing realistic goals that reflect their priorities and values. By setting clear and actionable financial goals, individuals can stay focused, motivated, and accountable as they work towards improving their financial well-being. Setting financial goals provides a roadmap for success, guiding individuals towards financial stability, security, and ultimately, achieving their dreams.

Developing Personalized Financial Plans: Tailored Strategies for Success

Developing personalized financial plans is a cornerstone of financial counseling, as it involves creating tailored strategies to help individuals achieve their unique financial goals. Through collaborative sessions with a certified financial counselor, clients assess their current financial situation, identify goals, and prioritize objectives. Based on this information, counselors design comprehensive financial plans that address specific needs and circumstances.

These plans may encompass various aspects of financial management, including budgeting, debt repayment, savings, investments, insurance, and retirement planning. Counselors work closely with clients to customize strategies that align with their values, preferences, and risk tolerance.

By tailoring financial plans to individual circumstances, clients gain clarity, confidence, and direction in managing their finances effectively. These personalized strategies provide a roadmap for success, guiding individuals towards financial stability, security, and long-term prosperity.

Implementing Budgeting and Debt Management Techniques

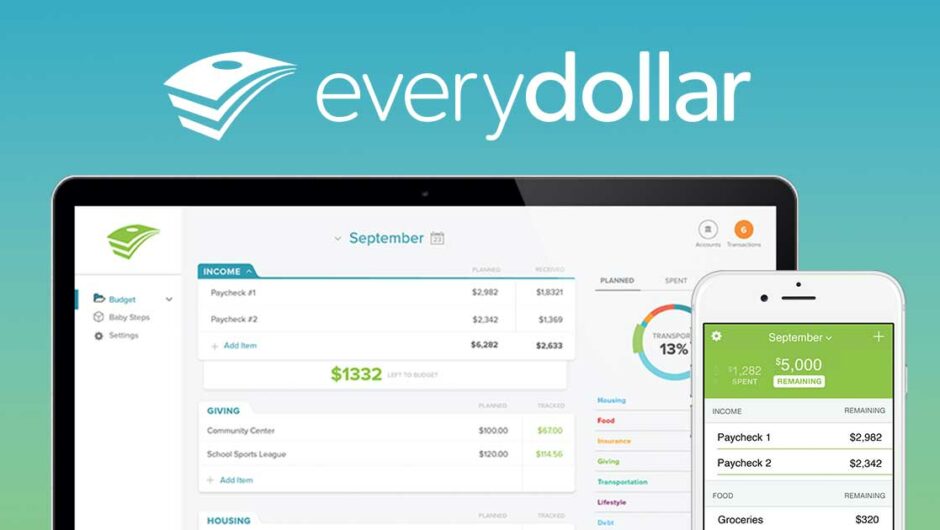

Implementing budgeting and debt management techniques is essential for individuals seeking to improve their financial health. Budgeting involves creating a plan to track income and expenses, allowing individuals to allocate funds effectively and prioritize spending. Through financial counseling, individuals learn to develop realistic budgets that align with their financial goals and lifestyle.

Debt management techniques help individuals address and reduce debt burdens. This may include strategies such as debt consolidation, negotiation with creditors, and developing repayment plans. Financial counselors provide guidance on managing debt responsibly, minimizing interest costs, and avoiding future debt traps.

Exploring Retirement Planning and Investment Strategies

Exploring retirement planning and investment strategies is crucial for individuals looking to secure their financial future. Retirement planning involves assessing current financial resources, setting retirement goals, and developing a plan to achieve those goals. Financial counselors assist clients in understanding retirement savings options, such as employer-sponsored retirement plans, IRAs, and annuities, and create personalized retirement savings plans.

Investment strategies play a vital role in retirement planning by helping individuals grow their wealth over time. Counselors educate clients about different investment vehicles, risk tolerance, and asset allocation strategies to build diversified investment portfolios aligned with their retirement goals and time horizon.

Addressing Financial Challenges: Overcoming Obstacles with Support

Addressing financial challenges with support from financial counseling is crucial for individuals facing obstacles in managing their finances. Financial counselors provide guidance and assistance in identifying the root causes of financial difficulties. Whether it’s excessive debt, inadequate savings, or poor budgeting habits.

Through personalized counseling sessions, individuals develop strategies to overcome financial challenges. Such as implementing budgeting techniques, managing debt effectively, and building emergency savings. Counselors offer practical solutions and ongoing support to help clients navigate through tough financial situations and achieve their goals. By addressing financial challenges with support from financial counseling, individuals gain clarity, confidence, and empowerment in managing their finances.

Conclusion

In conclusion, financial counseling offers invaluable support and guidance for individuals seeking to improve their financial well-being. Through personalized strategies and practical solutions, financial counseling empowers individuals to address challenges, set goals, and achieve financial success. By implementing budgeting techniques, managing debt effectively, exploring investment strategies, and planning for retirement. Individuals can build a solid foundation for their financial future. With the assistance of financial counselors, individuals gain the knowledge, skills, and confidence. That is needed to navigate through obstacles and achieve their financial goals, leading to greater stability, security, and prosperity in the long run.

Also Read:

- What is Dividend Investing and How to find Dividend Stocks?

- How do new mobile banking apps help access savings account better?

- Financial Advisor in India – The Best for your Financial Planning?

- What is inflation and how it impacts your financial plan?

Hello, I am Tanisha Kriplani, graduated in computer science from Delhi University. I am passionate about web content writing and have a strong interest in Data Analytics and Data Engineering.