Planning to retire early and wondering what are the steps you need to take that can help you take an early retirement? There is no one-size-fits-all answer to the question of how to retire early, but there are some basic steps you can take to increase your chances of achieving this goal.

To do so, you’ll need to plan ahead and save for your retirement. You’ll also need to make smart investments, create a budget and stick to it, and develop multiple streams of income.

Additionally, you may need to downsize your lifestyle and make some sacrifices. With enough planning and dedication, it is possible to retire early.

Why is it important to retire early?

Retiring early is important because it gives you more time to do things with your family, friends, and to do things you enjoy. There is only one life and a lot of things to do, and a lot of places to visit in this lifetime. A lot of people want to retire early but they fail at planning. To retire early, you need to save money and plan carefully. Otherwise, you may not have enough money to enjoy your retirement.

How much money do you need to retire early?

There is no one definitive answer to this question. It depends on a variety of factors, including how much you currently save, how much you expect to spend in retirement, and the rate of return you expect on your investments. But, generally speaking, you will need to save at least 25-30 times your annual expenses in order to retire comfortably.

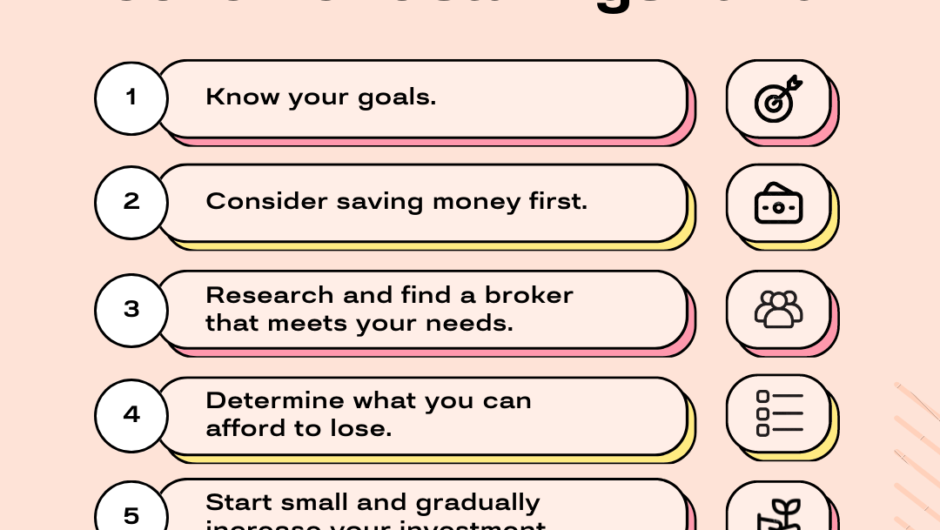

What are the 7 Steps to Retire Early?

Discussed below are some of the steps I think you should take if you are serious about taking an early retirement.

1. Save as much money as possible

The most important step in retiring early is saving as much money as possible. And as early as possible. You’ll need to have a large nest egg to support yourself in retirement. Try to save at least 20% of your income each year. This will help you reach your retirement goals sooner.

2. Invest your savings wisely

Where should you Invest your savings for early retirement? There is no one-size-fits-all answer to this question, as the best place to invest your savings for early retirement will vary depending on your individual financial situation and goals. However, some good places to start include investing in stocks, bonds, and other securities, or in a high yield savings account or certificate of deposit. If you are in your 30s, you can also consider investing a small part of your portfolio in cryptocurrencies. Remember, cryptocurrency is a high risk asset. Another option could be investing in real estate, or in a diversified portfolio of mutual funds. Ultimately, it is important to do your own research and determine the best investment strategy that meets your individual needs.

3. Review your expenses

Take a close look at your expenses and see where you can cut back. There may be areas where you can save money without making major changes to your lifestyle. There are times when because of not tracking the expenses, we end up spending more than we need, without us even knowing it. Thus, it becomes utmost important to review your expenses on a regular basis. Remember, every penny saved is another penny earned.

4. Invest in yourself

One of the best ways to increase your chances of retiring early is to invest in yourself. This means taking steps to improve your financial literacy and learn about different investment options. You could learn additional skills that can complement your current profession. For example, if you are a programmer, learning a new coding language can get you a hike in your company.

5. Stay disciplined

It’s important to stay disciplined with your spending and saving habits if you want to retire early. This means avoiding unnecessary expenses and sticking to a budget. If you are able to stick to a budget and not overspend, you will be able to save more money and have more funds to invest. This can help you generate more wealth over time. A mere 10% increase in yearly savings can result in a doubling of wealth accumulation over a 30-year period.

6. Consider working part-time in retirement

If you want to retire early, it’s a good idea to have a plan for how you will replace your income. One option is to work part-time in retirement. This can help to ensure that you have enough money to live on. For example, learning digital marketing can help you take freelancing tasks which can add to your earnings, and over a period of time, it can add to a good portion of your wealth.

7. Make a plan

The best way to achieve any goal is to make a plan. When it comes to retiring early, this means figuring out how much money you need to save and how you will invest it.

Making a plan early can help you retire early by helping you save money and by giving you a goal to work towards. Having a plan can also help you stay disciplined with your finances, which can be important when trying to save for retirement.

Additionally, having a plan can help you make smarter decisions with your investments, allowing you to maximize your retirement savings.

Finally, a plan can help you set retirement goals, ensuring you have the funds you need when you reach retirement age.

I think with these points, you will now be able to take an early retirement.

Before we end, I think it is important for you to also know a few downsides of retiring early.

Downside of retiring Early

There are a few potential downsides to retiring early. One is that you may not have enough money to live on. Another is that you may get bored if you don’t have anything to do. Third, you may miss the social interaction that comes with working. Fourth, you may not have enough money to cover your health care costs in future.

If you save enough, you may be able to overcome the monetary part. However, the biggest drawback is social interaction, and boredom. Even if you retire early, you should try to stay engaged. Travel. Make a to-do list, and keep achieving your short goals.

Happy retirement.

Hey, this is Johny Sehgal. I am the owner and caretaker at Finance Jungle. I completed my education in BSC and now heading towards the digital marketing industry. I usually have interests in reading, playing games and watching movies. I also love to write content based on quality information. The main motive of mine is to provide the top and best quality information to my readers. Finance Jungle is the blog for the same.