The idea of retiring in India after a successful stint abroad is an exciting proposition for many Non–Resident Indians (NRIs). However, it is important to consider a few important points before making this life–altering decision. In this article, we will look at the key points NRIs should take into consideration before retiring in India.

Definition of NRI

NRI stands for Non–Resident Indian. It is an Indian citizen who has migrated to a foreign country for work, residence, or any other purpose and has not taken up citizenship of that country. NRIs are considered to be Indian citizens even though they are living abroad and are subject to the same laws and regulations as citizens living in India.

Overview of Retiring in India

Retiring in India is becoming increasingly popular among NRIs. It is a great option for those looking to spend their golden years in the comfort of their own country, surrounded by family and friends. India has a number of attractive retirement benefits and options that make it an ideal destination for NRIs. Retirement in India is becoming attractive due to various factors like lower cost of living, access to high–quality healthcare, tax benefits, and access to a large expatriate community.

Additionally, there are a number of cultural attractions and activities that make India a great place to retire. Retiring in India can provide NRIs with an exciting and rewarding experience.

Advantages of Retiring in India

Retiring in India can be a great option for those looking to enjoy their retirement in a foreign country. India offers a variety of advantages to retirees, including a diverse culture, a wide range of leisure activities, and a low cost of living. Retiring in India can be a great experience for those looking to enjoy their golden years abroad. With a vibrant culture, a wide range of activities, and a low cost of living, India offers a number of advantages to retirees. let’s talk about few advantages!

Cost of Living: India is one of the most affordable countries to retire in, with a very low cost of living. The cost of basic goods and services is much lower than in many other countries. This makes it easier for retirees to stretch their budget and enjoy a comfortable lifestyle.

Access to Healthcare: India offers excellent access to quality healthcare. Many hospitals in the country are equipped with modern facilities and offer medical services at an affordable price. This makes it a great option for retirees who need regular medical care.

Cultural Connections: India is a very diverse and culturally rich country, with many different religions, languages, and traditions. Retiring in India allows you to experience the country‘s rich cultural heritage, which can be a great source of comfort and joy. You can also stay connected to family and friends who live in the country.

Challenges of Retiring in India

Retirement in India can present a number of challenges for those approaching the end of their working life. With limited access to public pensions and the cost of living rising in many parts of the country, retirees must be prepared to face a range of financial and lifestyle issues. With careful planning and adequate preparation, however, retirees can still enjoy a comfortable life in India. let’s discuss few challenges of retiring in India.

A. Language Barrier: Retiring in India can be challenging due to the language barrier. India has 22 official languages, and the language spoken in one region can be completely different to the language spoken in another. This can lead to confusion, misunderstanding and difficulty in communication when dealing with bureaucracy, taxation and other challenges associated with retirement. Learning the local language is a must for those considering retiring in India, as this will make the entire process easier.

B. Bureaucratic Process: The bureaucratic process in India is often complicated and time consuming. The process of obtaining visas, registering with the government, and sorting out taxation and healthcare can be long and tedious. It is important to understand the local regulations and processes, and to be patient with the bureaucracy. Having a local contact who can help guide you through the process can be beneficial in overcoming this challenge.

C. Taxation in India: Taxation in India can be complex, with different rules and regulations for different regions. It is important to understand the tax laws in the region you plan to retire, and to ensure that you are paying the correct amount of taxes.

There are various exemptions, deductions and benefits available for retirees, so it is important to find out what you are entitled to. Seeking professional advice from a qualified tax professional can help ensure that you are paying the correct amount of taxes.

Preparing for Retirement in India

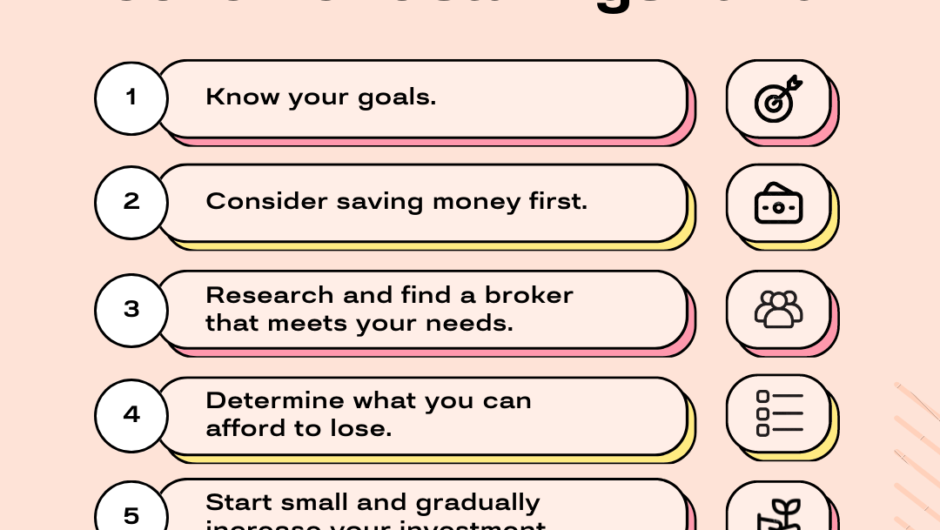

Retirement is an inevitable part of life, and as such, it is important to start preparing early. In India, people are increasingly realizing the importance of a sound retirement plan to ensure a comfortable life once they stop working. Here are a few tips to help you prepare for retirement in India:

A. Research Laws and Regulations: It is important to thoroughly research the laws and regulations that govern retirement in India. This includes looking into pension and retirement plans, tax laws, and any other regulations related to retirement. Researching the laws and regulations before retiring in India can help to ensure that you are making the most of your retirement income.

B. Choose a Location: When preparing for retirement in India, it is important to select a location that is suitable for your lifestyle. Consider factors such as the climate, cost of living, and the availability of healthcare services. Also, look into the cultural diversity of the area and the amenities that are available.

C. Get to Know the Local Culture: Once you have chosen a location, it is important to get to know the local culture. This can help you to settle into your new life in India and understand the customs, values, and traditions of the local people. Make an effort to meet the locals and learn about the cultural activities and festivals that are celebrated in the area.

FAQ

What are the important points to consider when an NRI retires in India?

Important points to consider when an NRI retires in India include obtaining a Resident Permit, obtaining a PAN Card, deciding on a place to stay, setting up a bank account and exploring retirement benefits.

How do I obtain a Resident Permit when an NRI retires in India?

An NRI needs to apply for a Resident Permit through the Indian Embassy or Consulate in the country they are currently residing in.

What are the retirement benefits for an NRI retiring in India?

Retirement benefits for an NRI retiring in India depend on the type of pension or retirement plan they have. Some popular options include the Employees‘ Pension Scheme, the Public Provident Fund and the Senior Citizens Savings Scheme.

Is there an age limit for an NRI to retire in India?

There is no age limit for an NRI to retire in India.

Do I need to pay taxes when an NRI retires in India?

Yes, NRIs are subject to taxes in India. They should consult with a tax advisor to determine the best tax plan for their retirement.

What are the healthcare facilities available when an NRI retires in India?

Healthcare facilities available when an NRI retires in India include private hospitals, government hospitals, and primary health centers. Documents needed when an NRI retires in India include passport, Resident Permit, PAN Card, proof of residence, and proof of income.

Conclusion

As an NRI, retiring in India comes with its own set of unique considerations. From cultural differences to financial planning, to healthcare and other services, it is important to take into account all potential factors before making the decision to retire in India. With careful planning, however, NRI retirees can enjoy the warm hospitality and rich cultural heritage of India, along with the security of financial stability and access to health care. A successful retirement in India is within reach for any NRI who is willing to put in the effort to make the transition a smooth one.