Investing in a retirement savings fund might be a great way to make sure you have the financial security you need to have a comfortable retirement. There are many advantages to investing in a retirement savings fund. However, there are also some drawbacks to investing in a retirement savings fund. overall, investing in this particular saving fund can be an amazing way to safeguard you have the financial security you need for retirement. However, it’s important to consider the advantages and disadvantages before making a decision. let’s discuss all about retirement saving fund in this article. But firstly, let’s understand what retirement fund is?

What is retirement saving fund?

A retirement savings fund is a type of savings or investment account that is specifically used to set aside money for retirement. These accounts can be used to accumulate money over time and provide tax advantages to help you save for the future. Examples include 401(k)s, IRAs, and annuities.

Advantages of Investing in Retirement Savings Funds

A retirement savings fund is one of the most powerful tools people have to ensure their financial security during retirement. Investing in a retirement savings fund offers a range of advantages, from tax benefits to long-term savings and increased financial security.

- Tax Benefits: Investing in a retirement savings fund offers significant tax benefits. Depending on the type of account, contributions may be tax-deductible, while investment earnings are tax-deferred until withdrawal. This can significantly reduce the amount of taxes paid on retirement savings.

- Long-term Savings: Retirement savings funds are designed to be a long-term investment vehicle. By investing regularly in a retirement savings fund, you can reap the rewards of compound interest, which can help your retirement savings grow exponentially over time.

- Increased Financial Security: By investing in a retirement savings fund, you can ensure that you will have a steady stream of income during retirement. This can help to reduce the risk of outliving your savings and give you the peace of mind that you will have financial security during your retirement years.

Overall, investing in a retirement savings fund can be a wise decision for anyone looking to ensure their financial security during retirement. With the potential for tax benefits, long-term savings, and increased financial security, a retirement savings fund is a valuable tool that can help you prepare for your golden years.

click to know best retirement funds.

Disadvantages of Investing in Retirement Savings Funds

Investing in retirement savings funds can be a great way to set yourself up for a comfortable retirement, but it is important to understand the potential drawbacks. Here we look at the three main disadvantages of investing in retirement savings funds:

- Risk of losing money: The risk of losing money, the potential of lower returns, and fees and commissions. The risk of losing money is one of the primary drawbacks of investing in retirement savings funds. This can be particularly significant for those who are nearing retirement, as any losses sustained could have a significant impact on their lifestyle in retirement. It is therefore important to assess the risk of each investment and ensure that it is in line with your goals and risk profile.

- Potential of lower returns: Another disadvantage of investing in retirement savings funds is the potential for lower returns. Often, retirement savings funds are conservatively managed, meaning that the potential for higher returns is limited. This can be beneficial in some ways, as it means that the risk of losses is also lower, but it may also mean that retirees are not able to benefit from higher returns that may be available elsewhere.

- Fees and commissions: Finally, fees and commissions can also be a drawback of investing in retirement savings funds. Some funds may charge high fees, which can eat into the returns earned from the investments. It is therefore important to carefully assess the fees and commissions of each fund before investing, to ensure that you are getting the best value for your money.

In conclusion, investing in retirement savings funds can be a great way to set yourself up for a comfortable retirement. However, it is important to understand the potential drawbacks, such as the risk of losing money, the potential for lower returns, and fees and commissions. Taking the time to understand the risks and benefits of each option is the best way to ensure that you make the right decision for your retirement.

FAQ

How do retirement savings funds work?

Retirement savings funds work by investing the money you put in them in the stock market and other financial instruments. The returns on these investments are used to generate income for you when you reach retirement age.

What are the risks of investing in retirement savings funds?

Like any type of investment, there are risks associated with investing in retirement savings funds. These include market volatility, inflation, and the risk of losing money. It is important to be aware of the risks associated with any investment and to diversify your investments as much as possible.

How much money should I invest in retirement savings funds?

The amount you should invest in retirement savings funds depends on your individual financial situation. Generally, it is recommended to invest 10–15% of your pre–tax income in retirement savings funds. However, you should consult a financial professional to determine the right amount for your specific situation.

What types of retirement savings funds are available?

There are a variety of retirement savings funds available, including traditional IRAs, Roth IRAs, 401(k)s, and annuities. It is important to research each type of fund to determine which one best meets your needs.

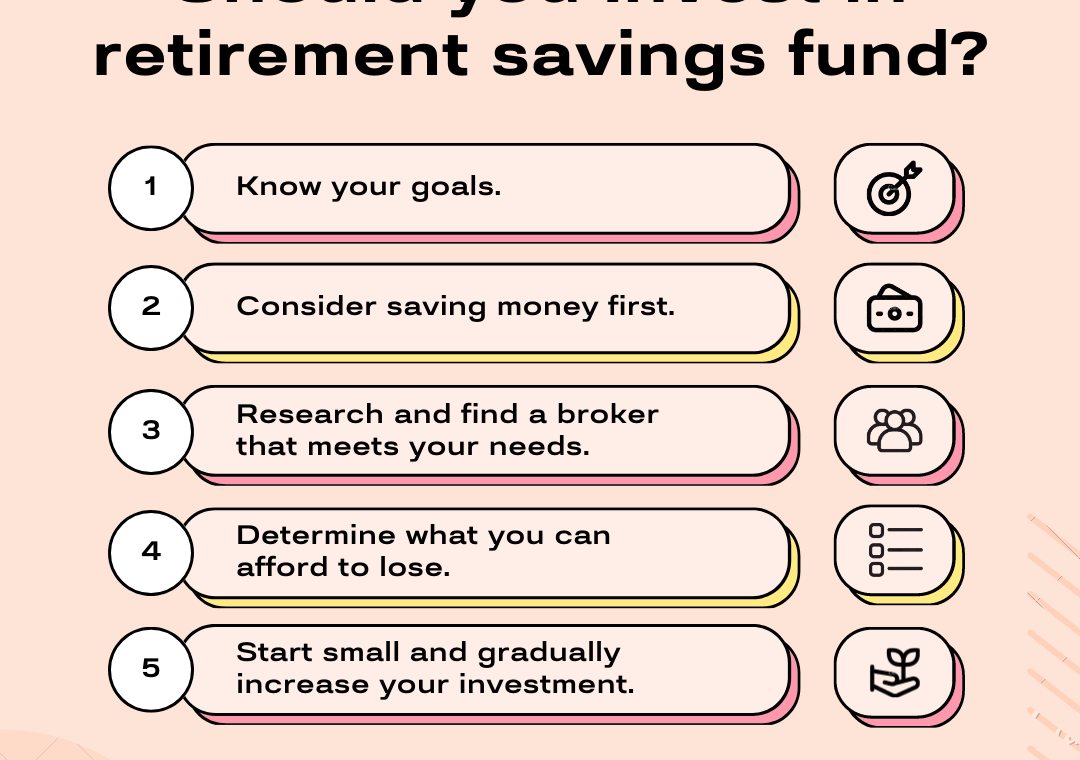

How do I choose the right retirement savings fund for me?

Choosing the right retirement savings fund for you depends on your individual financial situation and retirement goals. It is important to research the different types of funds available and consult with a financial professional to determine which one is best for you.

How do I open a retirement savings fund?

To open a retirement savings fund, you will need to contact a financial institution and open an account. You will then need to deposit money into the account and select the investments you want to make.

How do I make contributions to my retirement savings fund?

You can make contributions to your retirement savings fund on a regular basis, such as monthly or annually. You can also make one–time contributions. Generally, you can make contributions with a check, direct deposit, or payroll deduction.

How do I withdraw money from my retirement savings fund?

Generally, you can only withdraw money from your retirement savings fund after you reach retirement age. You may also be able to withdraw money earlier if you meet certain requirements. Additionally, some funds offer early withdrawal penalties. It is important to research the rules and regulations regarding withdrawals from your specific retirement savings fund before making any withdrawals.

Conclusion

The decision to invest in a retirement savings fund is a personal choice in the end and should be based on a thorough evaluation of your unique financial situation. It is very important to consider the long-term conclusion of such an investment and to consider the pros and cons of each option present. By checking this, you will be able decide if a retirement savings fund is the right decision for you or not.