Mortgage forbearance is an option that may allow you to temporarily suspend or reduce your mortgage payments. This can be a helpful option if you’re facing financial hardship, but it’s important to understand the qualifications and potential impacts. In this article, we’ll explore what mortgage forbearance means, how to qualify, and what you need to know before making a decision.

Introduction to Mortgage Forbearance

Mortgage forbearance is an option that allows borrowers to temporarily suspend or reduce their mortgage payments. It’s often used by homeowners who are facing financial hardship due to job loss, medical bills, or other unexpected expenses. Forbearance can provide relief by allowing borrowers to take a break from their mortgage payments without risking foreclosure. However, it’s important to understand how forbearance works, the qualifications for eligibility, and the potential impacts before deciding if it’s the right option for you.

How Mortgage Forbearance Works

Mortgage forbearance works by allowing borrowers to temporarily suspend or reduce their mortgage payments for a set period of time. During forbearance, the borrower is not required to make payments, but interest may continue to accrue on the outstanding balance. Once forbearance ends, the borrower must resume making regular payments or work with the lender to establish a repayment plan. The specifics of how forbearance works can vary depending on the lender and the borrower’s individual circumstances. It’s important to speak with your lender to understand the terms of forbearance and how it will impact your overall loan.

Qualifying for Mortgage Forbearance

Qualifying for mortgage forbearance typically requires demonstrating financial hardship, such as a job loss, medical emergency, or other unexpected expenses. To request forbearance, borrowers usually need to contact their lender and provide information about their situation, including documentation such as proof of income or medical bills. Lenders will evaluate each request on a case-by-case basis and may require additional information or documentation. It’s important to note that forbearance is not automatic and that borrowers must work with their lender to request and establish the terms of forbearance.

Potential Impacts of Mortgage Forbearance

While mortgage forbearance can provide relief for borrowers facing financial hardship, it’s important to understand the potential impacts before deciding if it’s the right option for you. One impact is that interest will continue to accrue on the outstanding balance during forbearance, which can result in larger payments or a longer loan term once forbearance ends. Additionally, forbearance can impact credit scores and eligibility for future loans. Finally, forbearance is not a long-term solution and may only provide temporary relief. Borrowers must work with their lender to establish a repayment plan or other long-term solution once forbearance ends.

Alternatives to Mortgage Forbearance

If mortgage forbearance is not the right option for you or if you don’t qualify, there may be alternatives to consider. One option is to request a loan modification, which can change the terms of your mortgage, such as the interest rate or loan term. Another option is to refinance your mortgage, which can allow you to take advantage of lower interest rates or change the terms of your loan. Additionally, if you are experiencing financial hardship due to job loss, you may qualify for unemployment benefits or other assistance programs that can help with mortgage payments. It’s important to explore all options and speak with your lender to find the best solution for your individual circumstances.

Conclusion: Is Mortgage Forbearance Right for You?

Mortgage forbearance can be a helpful option for borrowers experiencing financial hardship and struggling to make mortgage payments. However, it’s important to understand the potential impacts, including the accrual of interest and potential impact on credit scores and eligibility for future loans. It’s also important to explore alternatives to forbearance, such as loan modifications, refinancing, or assistance programs. Ultimately, the decision to pursue mortgage forbearance or an alternative solution will depend on your individual circumstances and financial goals. It’s important to speak with your lender and a financial advisor to determine the best course of action for your situation.

Also Read:

- Conditional Mortgage Approval: Tackling The Common Questions

- How Much Is Life Insurance In Canada?

- What are financial smart goals?

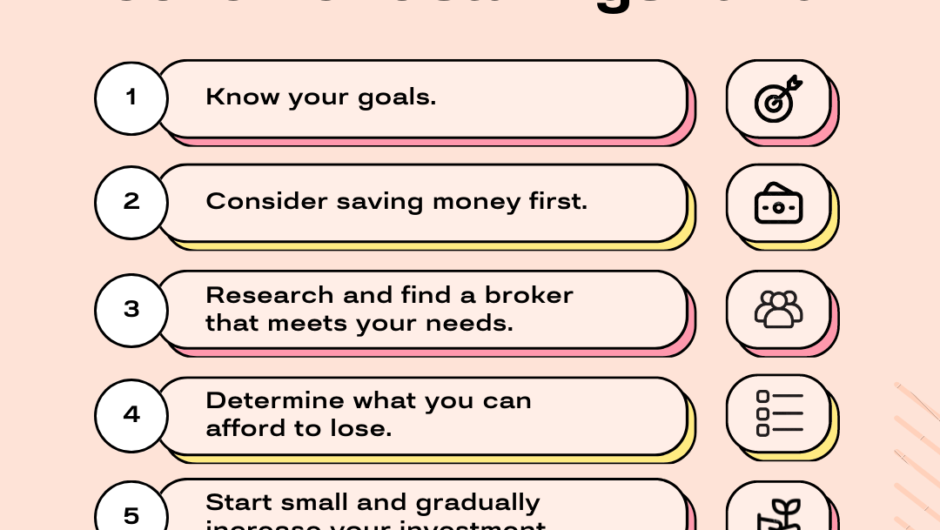

- WHAT ARE THE 5 STEPS OF FINANCIAL PLANNING?

Hello, I am Tanisha Kriplani, graduated in computer science from Delhi University. I am passionate about web content writing and have a strong interest in Data Analytics and Data Engineering.