Before starting investing in stocks, you must go through the investment strategies. Though there are many websites that publish articles, yet not all of them are reliable. Sometimes it might feel like investment books are boring but in reality, once you cultivate the habit of reading, you will get the fruits out of it.

These books give you an in-depth idea of personal finance matters to take better care of your financial future. Googling something means searching for things that validate self-beliefs. But only scrutinized information gives the actual perspective to us.

In this article, you will come to know about the handpicked investors business daily.

-

The Intelligent Investor

An investor’s business daily written by the father of value investing, Benjamin Graham presents in-depth ideas about security analysis. This book gives you an overview of the foundation for a generation of investors. The most astonishing part is that you’ll get the actual thoughts of his most famous student, Warren Buffett, Published in 1949, the book is in high demand even today among aspiring investors.

An investor’s business daily written by the father of value investing, Benjamin Graham presents in-depth ideas about security analysis. This book gives you an overview of the foundation for a generation of investors. The most astonishing part is that you’ll get the actual thoughts of his most famous student, Warren Buffett, Published in 1949, the book is in high demand even today among aspiring investors.

Read More – Top 7 Index Funds Performing Well In 2020

-

Common Stocks and Uncommon Profits

Written in 1958 by Philip A. Fisher, the book is the record of financial analysis. This gives a major influence on modern investment theory. The standard of this boom lies in the idea present regarding analyzing stocks based on growth potential.

Written in 1958 by Philip A. Fisher, the book is the record of financial analysis. This gives a major influence on modern investment theory. The standard of this boom lies in the idea present regarding analyzing stocks based on growth potential.

When investors read it, they can analyze the quality of a business as well as the ability for the production of the profits.

-

Rich Dad Poor Dad

Written in 1997 by Robert Kiyosaki, the classic investors business daily highlights some major points about investment and has become a must-read for young investors. Here, you will get the original idea about Kiyosaki related to how the poor and middle-class work for making some money. On the other hand, the rich work to learn and grow big. The importance is given to the point of the importance of financial literacy. It also gives a good presentation of financial independence. The book sticks to the ultimate goal of avoiding the rat race of corporate America. Besides, there’s a highlight given to the importance of accounting. His concept is that banks do label a house as an asset, but because of the maintenance of required payments. It also highlights how there’s reliability in terms of cash flow.

Written in 1997 by Robert Kiyosaki, the classic investors business daily highlights some major points about investment and has become a must-read for young investors. Here, you will get the original idea about Kiyosaki related to how the poor and middle-class work for making some money. On the other hand, the rich work to learn and grow big. The importance is given to the point of the importance of financial literacy. It also gives a good presentation of financial independence. The book sticks to the ultimate goal of avoiding the rat race of corporate America. Besides, there’s a highlight given to the importance of accounting. His concept is that banks do label a house as an asset, but because of the maintenance of required payments. It also highlights how there’s reliability in terms of cash flow.

-

The Essays of Warren Buffett-Lessons for Corporate America”

Written in 1997 by Warren Buffett, this book is a widely considered one that reflects the most successful investor of modern financial history. In this book’s particular essay, you will get to know about his views on a variety of topics relevant that usually are related to corporate America and shareholders. The investors business daily throws a major impact in the manner that the young investors get a glimpse of the interface that is working between a company’s management and the shareholders. It also gives a highlight of the thought processes that fuel the enhancement of a company’s enterprise value.

Written in 1997 by Warren Buffett, this book is a widely considered one that reflects the most successful investor of modern financial history. In this book’s particular essay, you will get to know about his views on a variety of topics relevant that usually are related to corporate America and shareholders. The investors business daily throws a major impact in the manner that the young investors get a glimpse of the interface that is working between a company’s management and the shareholders. It also gives a highlight of the thought processes that fuel the enhancement of a company’s enterprise value.

Buffett’s essays comprise the discussions on corporate governance, finance, investing, as well as alternatives to common stock. Besides, you’ll also get concepts about mergers, acquisitions, accounting policy, accounting, valuation, and tax matters.

-

“Beating the Street”

Written in 1993 by Peter Lynch, this book will give you a clear concept about the successful stock market investors. Besides, there is also information about hedge fund managers who belong to the past century. While reading this book, the investor will get an in-depth idea of the thought processes related to financial markets. It will give the power of deciding whether to buy or sell the stock in hand. This book highlights how Lynch believes that individual investors work as the backbone of exploiting market opportunities better than Wall Street. This, with these concepts, the investors get the encouragement to invest in what they know.

Written in 1993 by Peter Lynch, this book will give you a clear concept about the successful stock market investors. Besides, there is also information about hedge fund managers who belong to the past century. While reading this book, the investor will get an in-depth idea of the thought processes related to financial markets. It will give the power of deciding whether to buy or sell the stock in hand. This book highlights how Lynch believes that individual investors work as the backbone of exploiting market opportunities better than Wall Street. This, with these concepts, the investors get the encouragement to invest in what they know.

Must Read – A Complete Guide to FHA Loans: FHA Loans Made SIMPLE

-

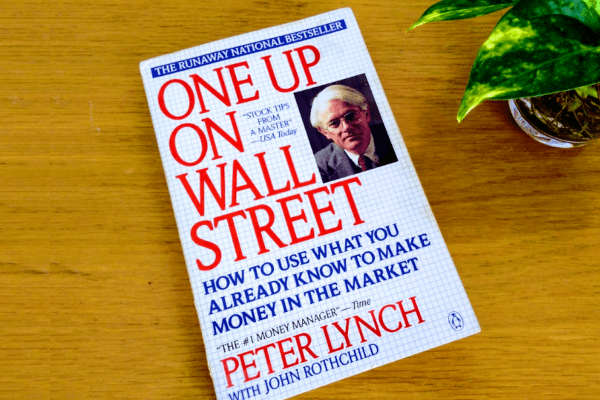

One Up On Wall Street

This book falls under the category of must-read books for investors in stock markets. Again, this book is by Peter Lynch that explains the basics that a beginner investor should know before investing. You’ll get all the answers like how, when, whys to the long-term approach of investment. The separate explanation of 6 different types of stocks and their approach will give you the detailed knowledge.

This book falls under the category of must-read books for investors in stock markets. Again, this book is by Peter Lynch that explains the basics that a beginner investor should know before investing. You’ll get all the answers like how, when, whys to the long-term approach of investment. The separate explanation of 6 different types of stocks and their approach will give you the detailed knowledge.

-

The little book that beats the market

The book is popular among the young and expert investors for its ‘MAGIC FORMULA’. The reader gets concept delayed to Earning yield & Return on Capital.

The book is popular among the young and expert investors for its ‘MAGIC FORMULA’. The reader gets concept delayed to Earning yield & Return on Capital.

You’ll also find the time-tested principles that are vital for the investors.

To Conclude:

Authors of these investment books have sufficient credibility, including an impressive portfolio, fame as well as years of experience. Stock investing requires reading, reading repeatedly and minutely. Only then you can develop a better habit of understanding financial proficiency, and patience to understand. Besides, the books deal with fundamental or technical analysis and have related subtopics.