Personal Loan finance is the best alternative to cover various financial needs. Over the last few years, Personal Loans have gained immense popularity among people who need funds to cover urgent expenses or fulfil long-awaited desires. Whether you need funds to plan for your honeymoon, pay for your study abroad programme, or deal with a medical emergency, you can manage the expenses with an instant Personal Loan. Let’s discuss how a Personal Loan is an easy solution to your urgent financial needs.

Types of Expenses You Can Cover with a Personal Loan

Personal Loan is generally useful for the following urgent expenses:

Higher Education

If you are planning to apply for a study abroad programme but the last date is just close, you can pay the tuition fees, research costs, internships, certification fees, travel costs, student visa fees, lodging and accommodation, study material and equipment, etc., with a Personal Loan.

Medical Emergency

Instant loans help cover unexpected medical bills for doctor’s fees, tests and diagnosis, hospitalisation, surgery, rehabilitation, etc. You cannot predict medical emergencies in advance. With a Personal Loan, you can get quick funds in hours to cover such unexpected costs.

Urgent Home Repair

Urgent home repairs like a plumbing malfunction, leaky roof, or storm damage must be done before you save money. A Personal Loan is an efficient home renovation loan to cover the costs associated with labour, materials, shipping, architecture, etc.

Last-Minute Wedding Costs

No matter how well you plan for a wedding, last-minute expenses are common during such grand events. Unexpected guests may arrive, service providers may not show up at the last minute, or a wardrobe malfunction may happen, demanding a hefty additional cost. Cover such charges with a Personal Loan to handle the situation confidently.

Unavoidable Travel Plan

If your family or friends plan a spontaneous trip and are not prepared for it, you can cover the costs with a Personal Loan for travel. Sometimes, you must travel abroad for work, health, or family matters. A Personal Loan can cover the costs while keeping your savings intact.

What Makes Personal Loan Finance the Go-To Solution for Urgent Financial Needs?

Here are a few features and benefits that make Personal Loans the go-to solution for urgent financial needs:

Achieve Financial Independence

Personal Loan finance has become extremely popular these days due to the sizeable amount of money it provides. For instance, Hero FinCorp offers instant Personal Loans of up to Rs 5 Lakh in minutes. It is handy when you need funds for medical emergencies, urgent home repairs, last-minute wedding expenses, etc.

No Collateral Requirement

Pledging collateral against a loan seems a risky proposition. You will lose the asset if a misfortune event happens and you fail to repay the loan. Luckily, Personal Loans do not require any collateral. Loan companies evaluate your eligibility based on your credit history, earnings, DTI ratio, and repayment capacity rather than keeping collateral against the loan amount. If you default, you will face legal consequences, but your assets will remain intact.

Easy Eligibility and Documentation

Gone are the days when you had to submit a long list of documents to apply for a Personal Loan. Now, financial institutions ask for just a few documents to verify your details, including your KYC documents, identity, income, address proof, etc. No physical branch visits and paperwork are required. Complete the whole process online and get approval in minutes.

Flexible Repayment

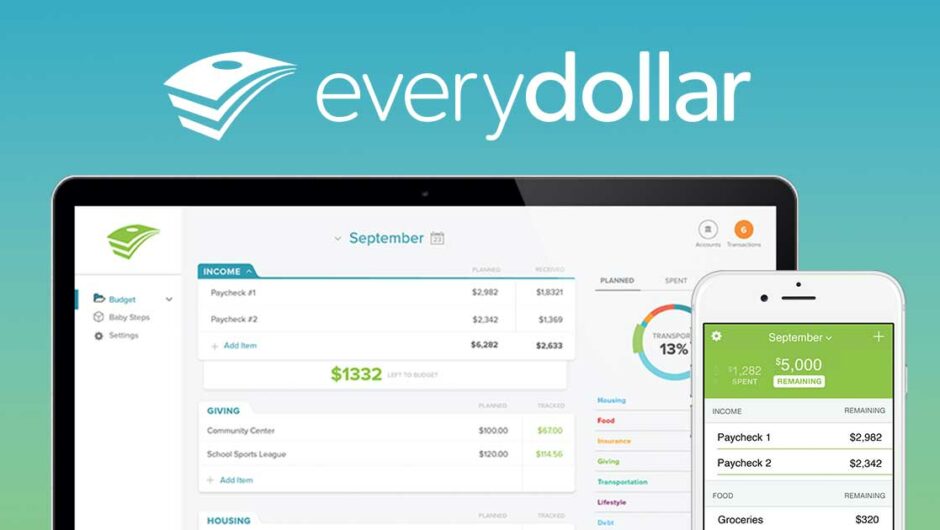

Normally, Personal Loans have a tenure of 60 months. However, you can choose a shorter term if the EMIs fit your repayment capacity. Remember, you have to strike a balance between your income and financial obligations to choose your repayment scheme. A shorter tenure means lower interest costs but bigger EMIs, while a longer term means smaller EMIs but higher interest costs. Use a Personal Loan EMI calculator to choose a loan plan with budget-friendly EMIs.

Quick Approval and Disbursement

Advanced technology has made connecting with online financial institutions and accessing the required loan amount in minutes easier.

Tips to Qualify for an Instant Personal Loan

Understand Your Loan Product

Before applying for a Personal Loan, understand the loan product carefully. Opt for one that best suits what you need. Understand the loan amount, additional charges, interest rate, and tenure the loan offers. Also, review the loan eligibility and documentation requirements to prepare the application appropriately for easy approval.

Seek a Loan Amount You Need

After understanding the loan product, you must estimate the amount required to cover the intended expense. You can calculate the monthly EMIs using an EMI calculator and borrow an amount you can easily repay.

Choosing a Reputable Financial Institution

Apply for a Personal Loan from a reputable financial institution only. A credible loan provider is registered with the authorities and supervised under regulations. Borrowing from a credible financial institution ensures transparency in the loan product and avoids any legal complications. This choice can also help you access the lowest interest rate Personal Loan.

Maintain a High Credit Score

Since credit score is a vital parameter determining your creditworthiness, make your payments on time, retain old accounts, and diversify your credit portfolio to maintain a high credit score. A score above 700-750 attracts bigger loan sanctions and makes you eligible for the lowest interest rate Personal Loan.

Reduce Your Financial Obligations

High financial obligations reduce your loan eligibility. Financial institutions perceive you as a high-risk borrower with more chances of loan default. Your debt-to-income ratio should be at most 30-40%. If you already spend much of your income on other commitments, you have a higher chance of missing EMI repayments.

Conclusion

In the world of personal finance, Personal Loan Finance is a reliable solution for urgent financial needs. These loans provide quick access to funds, and by researching, you can find a Personal Loan with the lowest interest rate. Whether you’re facing a medical emergency, home repairs, or unexpected expenses, Personal Loans offer a dependable way to navigate these challenges confidently. So, when urgency arises, remember that Personal Loan Finance is there to help you with the best interest rates available.

Hey, this is Johny Sehgal. I am the owner and caretaker at Finance Jungle. I completed my education in BSC and now heading towards the digital marketing industry. I usually have interests in reading, playing games and watching movies. I also love to write content based on quality information. The main motive of mine is to provide the top and best quality information to my readers. Finance Jungle is the blog for the same.