Managing the inventory levels becomes essential for the companies to show whether or not the sales efforts are effective. It also helps them show whether or not the costs are getting controlled in an effective way. The turnover ratio happens to be an essential measure when it comes to how massively a company can generate their respective sales from the inventory.

In a nutshell, inventory is the account of goods that a company features in the respective stocks that also include the work-in-progress materials, raw materials, as well as finished goods which are ultimately sold. As a matter of fact, inventory also includes the finished goods, for example, any clothing material in any departmental store. Nevertheless, inventory would add raw materials for finished goods’ productions.

An Introduction to Inventory Turnover:

Inventory turnover happens to be the number of times that any particular company replaces and sells the stock of goods during a particular period of time. As a matter of fact, inventory turnover helps in providing insight as to how any company would manage the costs and how their sales would turn out to be effective in the long run. Some of the points that you can not have been mentioned right below.

- With higher inventory turnover, it would be better since the turnover commonly refers to the fact that an organization is selling the goods in all respects more rapidly. It also means that the particular demand for the respective product of their company does exist.

- With low inventory turnover, it would apparently signify weaker sales. As a matter of fact, it also implies declining demand for the product of the company.

- With inventory turnover, the company will be provided with insights as to whether or not the company can manage the stock effectively. The company also may have the overestimated demand for their respective products and the purchased products that are shown by the low turnover. Contrariwise, in case the inventory turnover is high, then it would mean that the company might not be able to buy sufficient inventories. It also means that they might be missing out a lot on their sales opportunities.

- Inventory turnover also signifies the company’s effective sales as well as the departments for purchasing that are in sync with the company. On the ideal front, the inventory should also match the sales. As a matter of fact, it might be quite expensive for the company to hold on to the inventory which is not selling. This is why the inventory turnover might be an essential indicator when it comes to the effectiveness of sales. However, it also manages the operating costs as well. Contrary to what has been mentioned above, for the given sales’ amount, fewer inventories might also improve the inventory turnover.

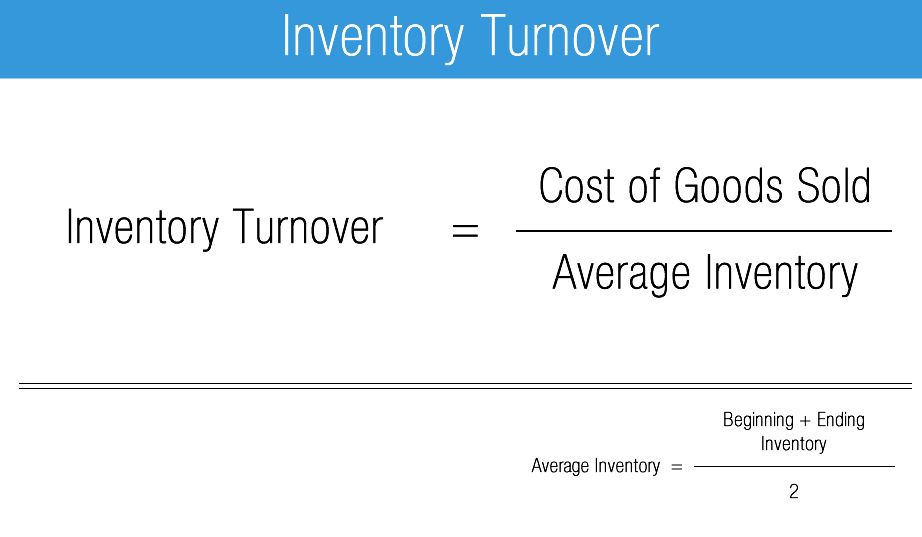

Note: Inventory also encompasses the goods of a particular company which has in the stock and the ones which will be sold in the end. It also indicates the number of times any company replaces or sells the goods’ stock during any particular period of time. The particular formula for the inventory turnover ratio happens to be the cost of goods that have been sold, divided by inventory for the time.

How will you Manage to Calculate the Turnover in no time?

Nothing unlike the typical turnover ratio, the inventory turnover is all about the details as to how much the inventory has been sold over a period of time. For calculating turnover ratio, good’s cost that is sold will get divided by inventory.

- Average inventory is something used in ratios. This is done because the companies come with lower or even higher inventory levels at the particular time in a year. For instance, the retailers in the market can likely have higher inventory which can lead up to holidays in Q4. As a matter of fact, it can also include lower inventory level in Q1 following the respective holidays.

- Also known as COGS, the cost of goods sold happens to be the measurement of the cost goods’ of production as well as the service for the respective company. It can even include the material cost as well as labor costs which would be directly related to the goods that have been produced.

- DSI or the days sales of inventory, aka Days Inventory, measures the number of days that are taken for the inventory to turn into a sales figure. This is also calculated by taking inverse inventory turnover ratio. As a matter of fact, this is multiplied by 365. This puts the daily figure as mentioned right below.

(Average Inventory divided by Cost of Goods Sold) multiplied by 365

When the DSI is lower, It becomes ideal due to the fact that it helps in translating to the fewer days that are required for turning the turn inventory into a cash figure. Nevertheless, the value of the DSI varies between several industries. As a result, this becomes essential for the company to compare DSI with the peers. Instantly, the companies can sell the groceries which come with lower day inventory than the companies selling automobiles.

Lastly,

Talking about inventory turnover ratio, this is most effective measure for any firm or company to make inventory turning into effective sales. This ratio also implies how managing the management is towards the association of cost with the inventory. This also makes sure whether they are investing too much or too little. In addition to that, a turnover ratio which is higher is always preferred and it indicates have been generated given that there was an amount of inventory. At times, a high inventory ratio can also result in a lost sales figure. This is due to the fact that there aren’t enough inventories that can meet the demand. As a matter of fact, it would be always be a quintessential factor to compare turnover ratios to industrial benchmark.

Hey, this is Johny Sehgal. I am the owner and caretaker at Finance Jungle. I completed my education in BSC and now heading towards the digital marketing industry. I usually have interests in reading, playing games and watching movies. I also love to write content based on quality information. The main motive of mine is to provide the top and best quality information to my readers. Finance Jungle is the blog for the same.