“In the United States, the number of self-employed individuals has skyrocketed in recent years – up to 7.6 million people in 2020, according to the Bureau of Labor Statistics. As self-employment becomes increasingly popular, understanding self-employment taxes is essential. As Buffet famously said, ‘It doesn’t matter how amazing the efforts or talent, some things take time’. The same applies to taxes – understanding the basics of self-employment taxes takes time and effort.

What is Self-Employment tax?

Employment Tax is a tax imposed to fund Social Security and Medicare benefits for self-employed individuals. This tax is a combination of contributions from employers and employees, which is usually collected and paid to the Internal Revenue Service (IRS) quarterly.

Self-Employment Tax applies to individuals who are self-employed, such as independent contractors and freelancers, as well as business owners who own and operate a business without any employees.

Overview of Self-Employment Tax Requirements

Self-Employment Tax is made up of two components: Social Security and Medicare taxes. The Social Security portion of Self-Employment Tax is 12.4% of net earnings and the Medicare portion is 2.9%. As a self-employed individual, you are responsible for paying the full 15.3% of your net earnings. The Self-Employment Tax is reported on Schedule SE with the individual’s annual tax return. In addition to paying Self-Employment Tax, those who are self-employed are also required to make estimated tax payments throughout the year. Estimated tax payments are due four times a year and are based on the self-employed individual’s estimated income tax liability for the year. Failure to make estimated tax payments can result in penalties and interest.

Self-Employment Taxes and Who Pays Them

Anyone who is self-employed and earns more than $400 in a year is subject to self-employment taxes. This includes those who are freelancers, independent contractors, and those who are running their own business. Self-employed individuals are responsible for paying both the employer and employee portions of Social Security and Medicare taxes.

How Self-Employment Taxes are Calculated Self?

Employment taxes are calculated based on the net income of the business. This is the total income minus any deductible expenses. The rate for Social Security tax is 12.4% of the net income and the rate for Medicare tax is 2.9%, for a total of 15.3%.

The self-employed individual is responsible for paying both the employer and employee portions of the taxes. This means that the total tax rate is double the rate for those who are employed by someone else. In addition to the self-employment taxes, self-employed individuals may also be required to pay estimated taxes. These taxes are due quarterly and are based on the estimated income for the year. It is important for self-employed individuals to stay up to date on all taxes due to avoid penalties and interest fees.

Filing Self-Employment Taxes

Filing self-employment taxes can be a daunting task for the uninitiated. Fortunately, the process is relatively straightforward and doesn’t require an accountant or tax advisor. First, you’ll need to obtain an IRS Form 1040-ES and complete it as accurately as possible. This form is used to calculate and pay estimated taxes on your self-employment income. Additionally, you’ll need to complete a Schedule C form to report income and expenses related to your self-employment. Once both forms are completed, you can submit them to the IRS either electronically or by mail.

The deadlines for filing self-employment taxes vary depending on the year. Generally, the due dates are April 15, June 15, September 15, and January 15 of the following year. If the due date falls on a weekend or federal holiday, the deadline is extended to the next business day. Additionally, you can make quarterly estimated payments to the IRS in order to avoid any potential penalties. It’s important to note that if you fail to file or pay your estimated taxes on time, you may be subject to penalties and interest.

Benefits of Self-Employment

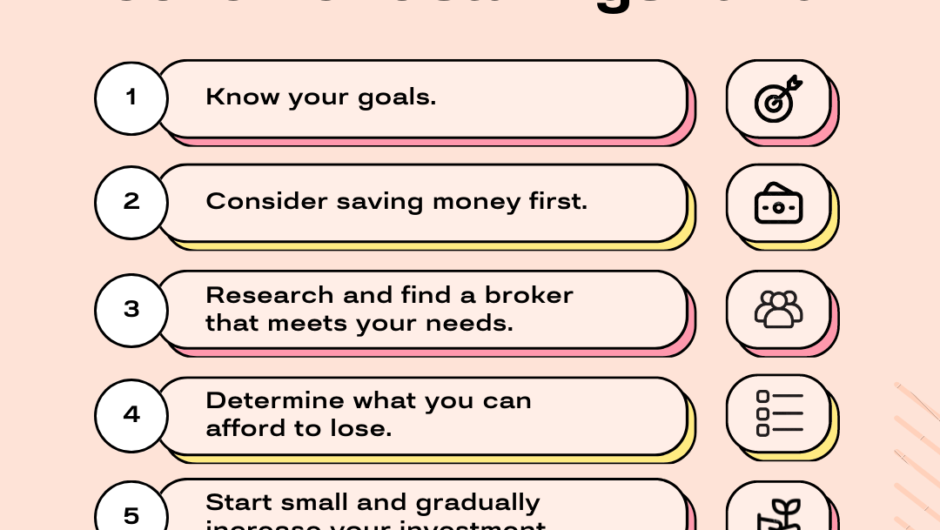

Tax Advantages of Self-Employment

- Self-employment provides a number of tax advantages, including the ability to deduct business expenses. This can be particularly helpful for those who are self-employed because they can deduct the cost of items such as office supplies, transportation, and depreciation of assets.

- Additionally, self-employed individuals are able to deduct a portion of their health insurance premiums, as well as any contributions they make to a retirement plan. This can result in substantial savings on taxes each year.

Other Benefits of Self-Employment

In addition to the tax advantages, there are many other benefits to self-employment. One of the greatest benefits is the freedom to be your own boss. Being self-employed means, you have the flexibility to create your own hours and set your own goals. You can also choose to work on projects that you are passionate about and that you find meaningful.

Additionally, self-employment allows individuals to gain valuable experience in a variety of areas, such as business management, customer service, and marketing. Finally, self-employment can be a great way to make a living while still having the freedom to pursue other interests.

FAQ

How much is self–employment tax?

The self–employment tax rate is 15.3%. The rate is composed of two parts: 12.4% for Social Security and 2.9% for Medicare.

Who is required to pay self–employment tax?

Self–employment tax is required to be paid by those who are self–employed, such as freelancers, independent contractors, and business owners who do not have employees.

When must self–employment tax be paid?

Self–employment tax is due when you file your federal income tax return and should be paid by the tax filing deadline (usually April 15th).

Are there any deductions available for self–employment tax?

Yes, you can deduct 50% of your self–employment tax.

Are self–employed people required to pay estimated taxes?

Yes, the IRS requires self-employed people to pay estimated taxes four times a year.

How is self-employment income reported?

Self-employment income is reported on Form 1040 Schedule

Are there any exemptions from self-employment tax?

Yes, there are some exemptions from self–employment tax for certain types of income, such as income from rental properties or from S corporations.

Are there any other taxes that self–employed people must pay?

Yes, self–employed people may have to pay other taxes such as state income tax, local taxes, and excise taxes.

Is there any way to reduce my self–employment tax liability?

Yes, there are several ways to reduce your self–employment tax liability, such as taking advantage of deductions, credits, and other tax strategies.

Conclusion

Successful entrepreneurs know that self-employment taxes are an important part of being your own boss. As Confucius said, ‘Where there is a will, there is a way’. Investing the time to understand the basics of self-employment taxes is the first step to achieving success as a self-employed individual. Self-employment taxes can be a bit confusing, but it pays to understand the basics. It is true that knowledge is power and understanding the basics of self-employment taxes is an important first step in achieving financial freedom and security.