Relief bonds are often issued by governments or central banks as a means to raise funds for specific relief or developmental purposes. These bonds are essentially debt instruments that individuals can invest in, contributing to a pool of funds that can be utilized for initiatives such as disaster relief, infrastructure development, or other socioeconomic projects. Investors typically receive fixed interest payments over a specified period, and the principal amount is repaid upon maturity.

Introduction to RBI Relief Bonds

RBI Relief Bonds represent a financial instrument issued by the Reserve Bank of India (RBI) with the primary objective of mobilizing funds for specific relief and developmental purposes. These bonds serve as a means for individuals to contribute to critical initiatives such as disaster relief, infrastructure development, or other socioeconomic projects undertaken by the government. With a focus on financial inclusion and public participation, RBI Relief Bonds offer individuals an avenue to invest in a secure and government-backed instrument while supporting causes that contribute to the nation’s welfare.

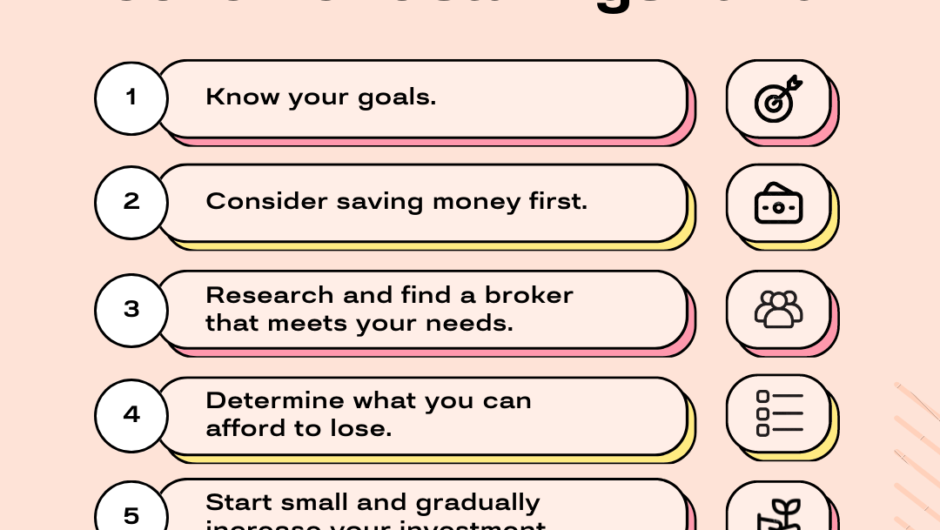

These bonds typically come with predetermined interest rates, fixed payment structures, and specific maturity periods. Investors receive regular interest payments over the bond’s tenure, and the principal amount is repaid upon maturity. The issuance of RBI Relief Bonds underscores the central bank’s commitment to leveraging public savings for targeted and impactful initiatives, aligning financial objectives with broader national development goals. As with any investment, individuals considering RBI Relief Bonds should carefully evaluate the terms, risks, and potential returns, while staying informed about any updates or modifications to the bond program by the Reserve Bank of India.

Features and Characteristics

RBI Relief Bonds exhibit distinct features and characteristics that make them a unique investment avenue. Firstly, these bonds are typically issued with fixed interest rates, providing investors with a predictable income stream throughout the bond’s tenure. The predetermined interest payment structure ensures stability in returns, making it an attractive option for risk-averse investors seeking a reliable investment vehicle.

Maturity periods associated with RBI Relief Bonds vary, allowing investors to choose from different tenures based on their financial goals and preferences. Additionally, the bonds often come with a lock-in period during which premature withdrawals may be restricted, promoting a commitment to the intended purpose of supporting relief and developmental initiatives.

Investment process for RBI Relief Bonds

The investment process for RBI Relief Bonds is designed to be accessible and straightforward, allowing individuals to contribute to crucial relief and developmental efforts. To initiate the investment, individuals can typically purchase these bonds through designated channels, including banks and financial institutions authorized to distribute government securities.

Prospective investors are required to complete the necessary documentation, which often includes Know Your Customer (KYC) procedures to comply with regulatory requirements. This involves providing identification and address proof along with other relevant details. The application process for RBI Relief Bonds may be conducted through both online and offline modes, providing flexibility and convenience for investors. Online applications often involve digital platforms offered by authorized entities, streamlining the process for tech-savvy investors.

Role of RBI in Socioeconomic Development

The Reserve Bank of India (RBI) plays a pivotal role in socioeconomic development through the issuance of Relief Bonds. By facilitating the mobilization of funds from the public through these bonds. The RBI acts as a conduit for channeling resources towards critical developmental initiatives. The funds raised are often earmarked for projects such as disaster relief, infrastructure development, and other key socioeconomic programs. Through the issuance of Relief Bonds, the RBI not only fosters financial inclusion by providing a secure investment. Avenue for individuals but also promotes a sense of civic participation. Investors, by contributing to these bonds, become integral stakeholders in the nation’s development. Also aligning their financial goals with broader societal objectives.

The central bank’s involvement in socioeconomic development extends beyond the financial realm. By directing funds towards specific projects, the RBI contributes to the creation of essential infrastructure, disaster resilience, and overall economic growth. This role underscores the RBI’s commitment to fostering a stable and prosperous environment. Where financial instruments serve as tools for both individual wealth creation and collective nation-building. The collaboration between the RBI and investors, facilitated through Relief Bonds. Exemplifies the synergy between financial institutions and the broader goals of societal advancement.

Investor FAQs about RBI Relief Bonds

1. What are RBI Relief Bonds?

- RBI Relief Bonds are financial instruments issued by the Reserve Bank of India. To raise funds for specific relief and developmental purposes. Investors contribute to these bonds, supporting initiatives such as disaster relief and infrastructure development.

2. How can I invest in RBI Relief Bonds?

- Investors can purchase these bonds through authorized banks and financial institutions. The application process involves completing necessary documentation, including KYC procedures.

3. What is the lock-in period for RBI Relief Bonds?

- Relief Bonds may have a lock-in period during which premature withdrawals are restricted. Investors should be aware of this period and plan their investments accordingly.

4. How are interest payments made?

- Interest payments are typically made at regular intervals throughout the bond’s tenure. Investors receive fixed interest rates on their investments.

5. What is the maturity period of RBI Relief Bonds?

- The maturity period varies, and investors can choose from different tenures based on their financial goals. The principal amount is repaid upon maturity.

6. Can I redeem RBI Relief Bonds before maturity?

- Early redemption options may be restricted during the lock-in period. After this period, investors may have the flexibility to redeem bonds before maturity, subject to certain conditions.

Conclusion

In conclusion, RBI Relief Bonds stand as a dual opportunity for investors. Combining financial security with a commitment to national development. Offering stable returns, government backing, and the chance to contribute to crucial initiatives. These bonds align individual financial goals with broader societal objectives. As investors actively participate in shaping the country’s progress. The collaboration between individuals and the Reserve Bank of India exemplifies a harmonious synergy between economic growth and responsible investment. With the potential to drive socioeconomic development, RBI Relief Bonds serve as a testament to the impactful role. That financial instruments can play in fostering a prosperous and resilient nation.

Also Read:

- Fixed Deposits vs Money Market Funds ; Which One is Right for You?

- International Mutual Funds in India- Should you Invest?

- Should you Invest in retirement savings fund?

- Potential Risk Matrix in Debt Mutual funds- How to Interpret?

Hello, I am Tanisha Kriplani, graduated in computer science from Delhi University. I am passionate about web content writing and have a strong interest in Data Analytics and Data Engineering.